40 deferred revenue asset or liability

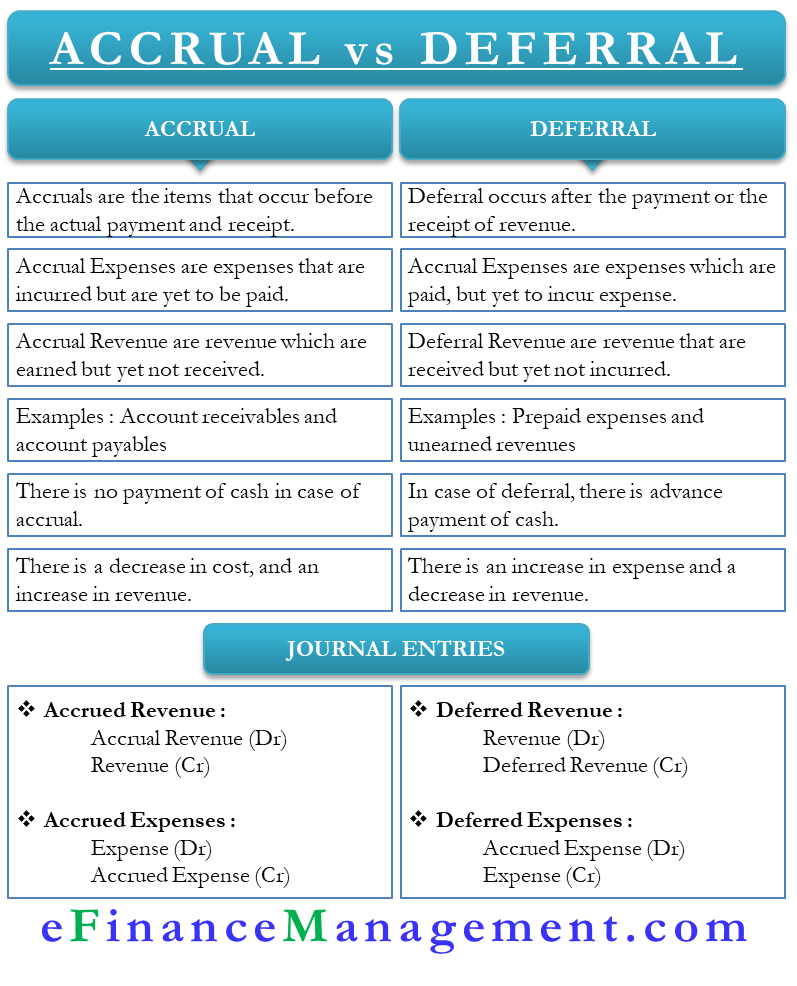

Deferred Revenue Definition - Investopedia May 24, 2020 · Deferred revenue, or unearned revenue , refers to advance payments for products or services that are to be delivered in the future. The recipient of such prepayment records unearned revenue as a ... Is deferred revenue a liability? - Accounting Capital Deferred revenue isan amount received by an entity in advance before delivering the goods or transferring the title to goods or before rendering the services. The concept of deferred revenueapplies only if an entity follows the Accrual Systemof Accounting. If the entity follows the cash system of accounting it’s of no relevance as the entire amount received becomes income in the year of receipt.

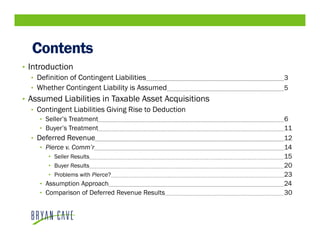

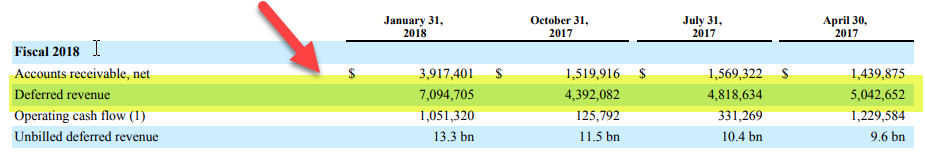

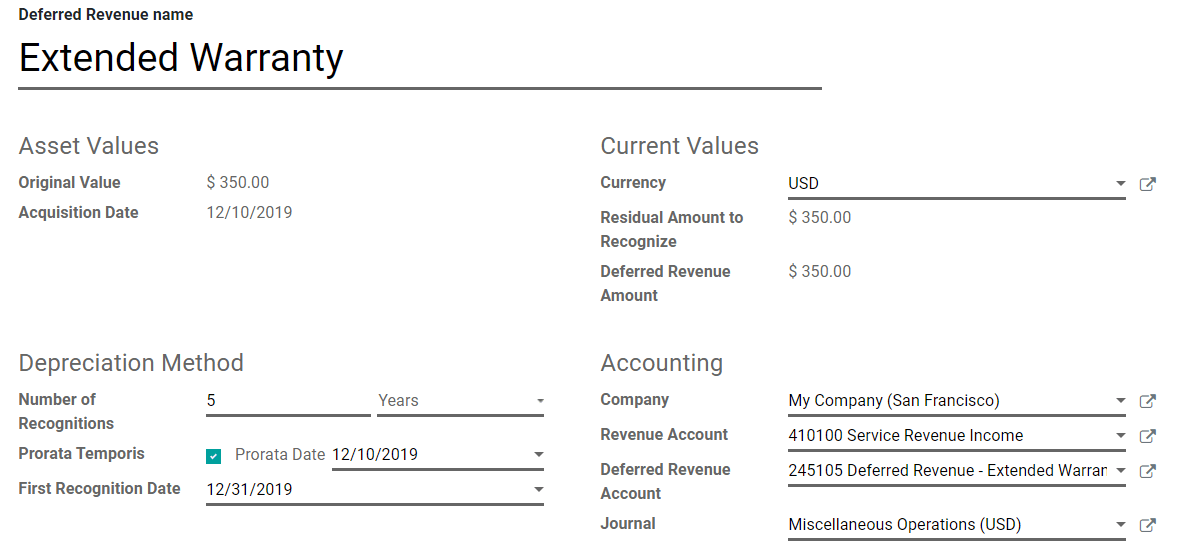

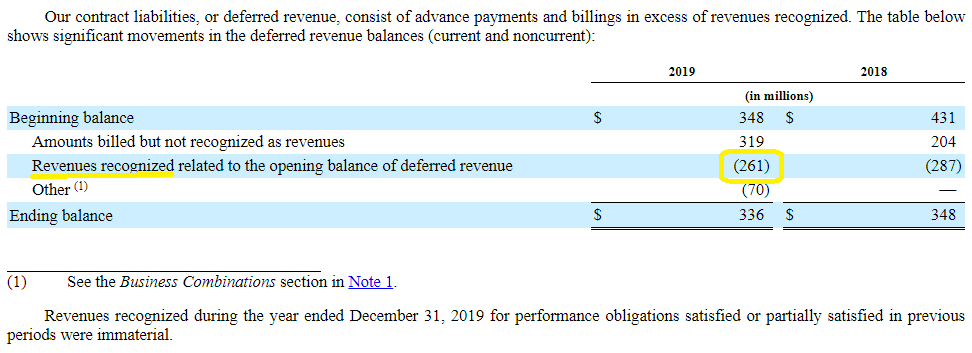

Where Did the Deferred Revenue Go in Your Acquisition ... Why Deferred Value Changes in a Deal. What does happen to deferred revenue during a transaction? Under purchase price accounting rules, assets and liabilities acquired as part of a business must be revalued at their fair value as of the acquisition date. For most assets and liabilities, this is a straightforward process.

Deferred revenue asset or liability

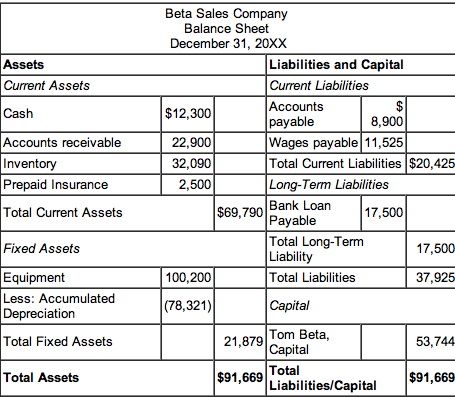

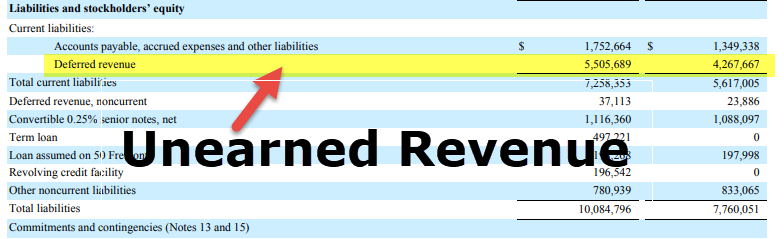

Is Deferred Revenue a Liability? - Baremetrics Aug 25, 2021 · Deferred revenue shows up in two places on the balance sheet. First, since you have received cash from your clients, it appears as part of the cash and cash equivalents, which is an asset. However, since you have not yet earned the revenue, deferred revenue is shown as a liability to indicate that you still owe the client your services. Is Deferred rent an asset? - FindAnyAnswer.com Deferred rent is defined as the liability that is created as a result of the difference between the actual cash paid and the straight-line expense recorded on the financial statements. Also Know, is Deferred rent a current or long term liability? Why is Deferred Revenue Treated as a Liability? Deferred revenue, which is also referred to as unearned revenue, is listed as a liability on the balance sheet because, under accrual accounting, the revenue recognition process has not been...

Deferred revenue asset or liability. Deferred Tax Assets (Meaning, Calculation) | Top 7 Examples The journal entry for deferred tax asset is: Current Tax Expense Dr. To Deferred tax liability To Income tax liability. read more in its book for $150. Conclusion. Deferred tax assets in the balance sheet line item on the non-current assets, which are recorded whenever the Company pays more tax. The amount under this asset is then utilized to ... Determining the Fair Value of Deferred Revenue | Valuation ... Under Accounting Standards Codification (ASC) 805, an acquirer must recognize any assets acquired and liabilities assumed, and any noncontrolling interest in the acquiree at the acquisition date, measured at fair value as of that date. Deferred revenue is a liability and meets the identification criteria. Report on Treatment of "Deferred Revenue" by The Buyer in ... consequences to the buyer of assuming a deferred revenue liability in a taxable asset acquisition of a business. Although the recommendations in this report are limited to the tax treatment of the buyer, the report discusses the tax treatment of both the buyer and the seller in these transactions. Deferred revenue is a type of liability. Classification of Deferred Outflows/Inflows of Resources ... 3.5.1.60 GASB expressly reserved for itself the determination of which items traditionally reported as assets or liabilities should be reclassified as deferred outflows or inflows of resources. The use of the term deferred should be limited to items reported as deferred outflows or inflows of resources.

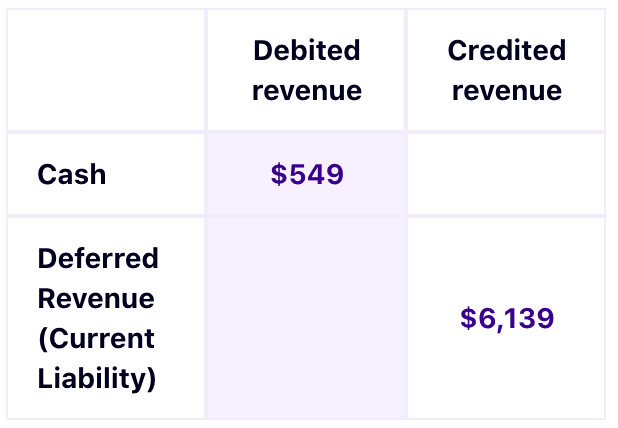

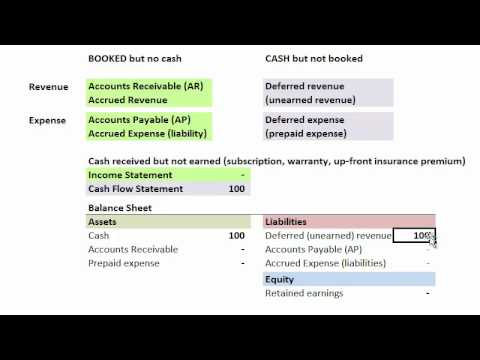

Deferred Revenue - Understand Deferred Revenues in Accounting Deferred Revenue (also called Unearned Revenue) is generated when a company receives payment for goods and/or services that have not been delivered or completed. In accrual accounting , revenue is only recognized when it is earned. If a customer pays for goods/services in advance, the company does not record any revenue on its income statement What are Deferred Tax Assets and Liabilities? Deferred tax assets and liabilities both represent an amount of money that is owed in two different ways: deferred tax assets are owed to the company, while deferred tax liability is owed to the government Depreciation is the one common point between deferred tax assets and liabilities that creates discrepancies in tax and accounting calculations. What is deferred revenue? Is it a liability & accounting for it Why is deferred revenue considered a liability? Businesses and accountants record deferred revenue as a liability (a balance sheet credit entry) because it represents products and services you owe your customers—for example, an annual subscription for SaaS software, a retainer for legal services, or a hotel booking fee. Is Deferred revenue a contract liability? Deferred revenue is included as a liability because goods have not been received by the customer or the company has not performed the contracted service even though money has been collected. Deferred revenue is classified as either a current liability or a long-term liability. Additionally, what is an example of a deferred revenue?

Details for Repair Revenue Asset Or Liability and Related ... Is Deferred Income an Asset or a Liability? On a company's balance sheet, deferred revenue is a liability because it represents an obligation to a customer (i.e. the customer has prepaid for goods and services). More › 238 People Used More Info ›› Visit site Capital and Revenue Expenditure | Accounting Hub new A Riddle, Wrapped in a Mystery, Inside an Enigma - The ... As a result, the fair market value of the acquired assets is $3 million, consisting of the cash paid of $2.5 million for the net assets and the assumption of the $500,000 liability for the cost to fulfill the deferred revenue obligation by the buyer. Instructions for Form 8854 (2021) | Internal Revenue Service Ineligible deferred compensation item means any deferred compensation item that is not an eligible deferred compensation item. The amount of this deferred compensation item (the present value of the accrued benefit) must be included on your Form 1040 or 1040-SR, or other schedule, for the portion of your tax year that includes your expatriation date. For more … Deferred Tax Asset Definition - investopedia.com 2021-09-10 · A deferred tax asset is an item on the balance sheet that results from the overpayment or the advance payment of taxes. It is the opposite of a deferred tax liability, which represents income ...

The cost of deferred revenue - The Tax Adviser The law known as the Tax Cuts and Jobs Act amended Sec. 451 to allow accrual-basis taxpayers to defer recognizing income until it is taken into account in their applicable financial statements. This rule can eliminate some book-tax timing differences regarding unearned revenue, also known as deferred revenue.

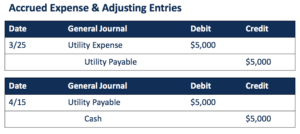

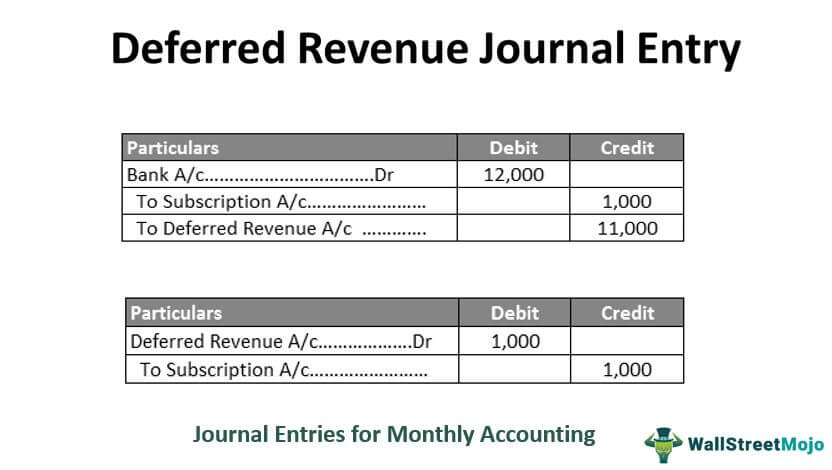

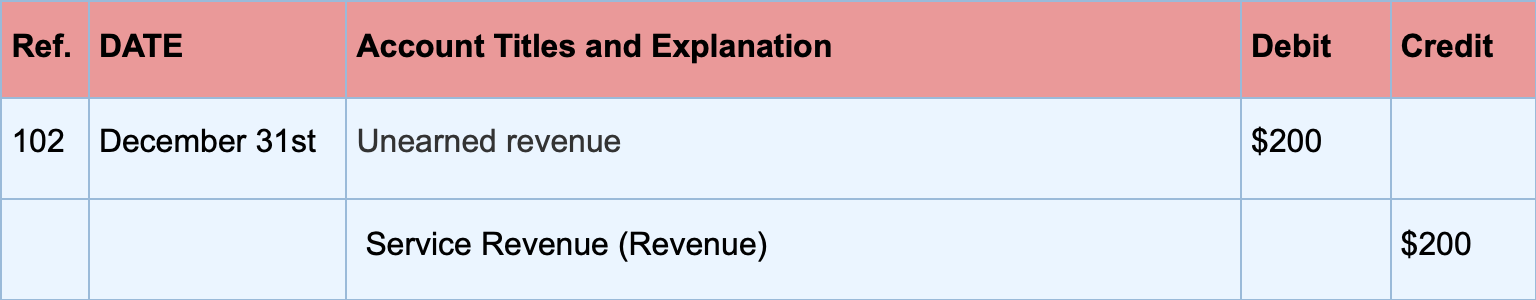

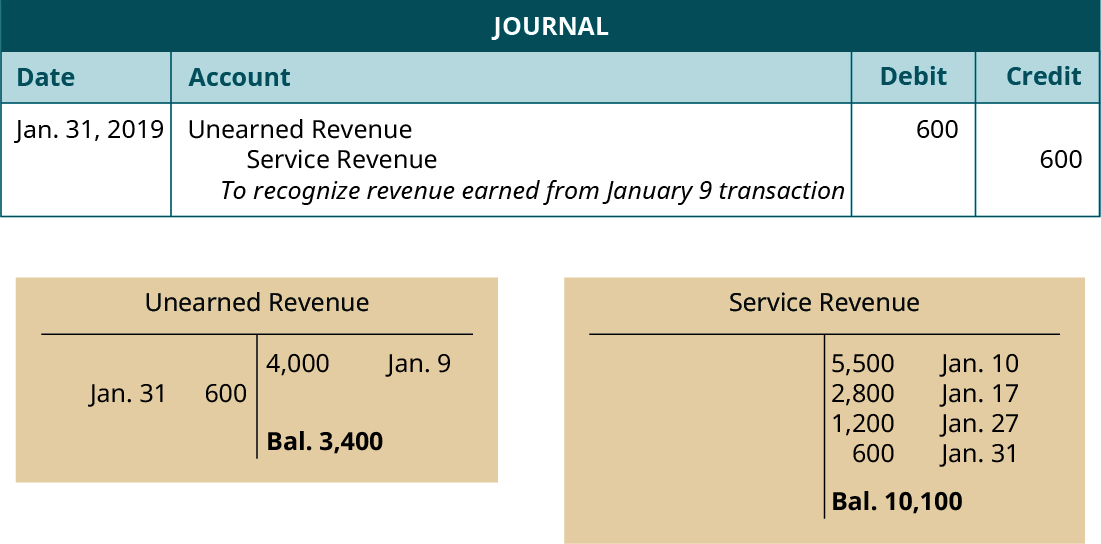

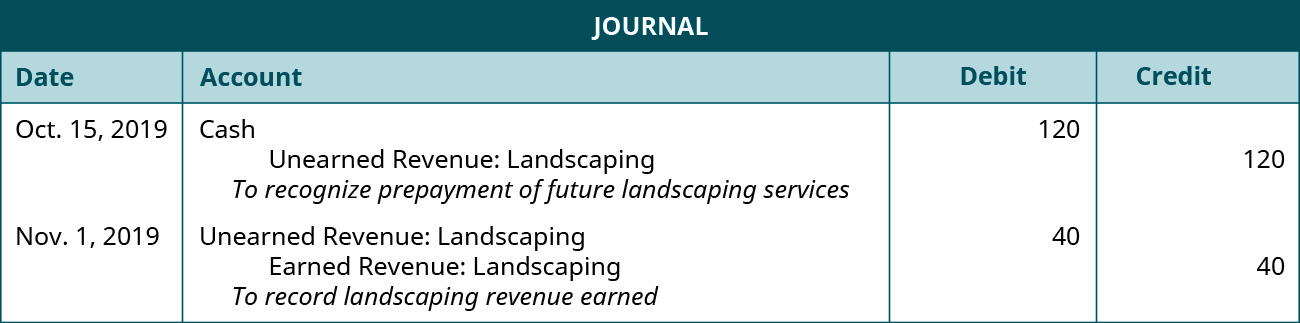

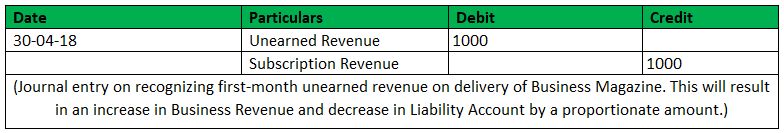

Accounting 101: Deferred Revenue and Expenses - Anders CPA Accounting for Deferred Revenue. Since deferred revenues are not considered revenue until they are earned, they are not reported on the income statement. Instead they are reported on the balance sheet as a liability. As the income is earned, the liability is decreased and recognized as income. Here is an example for a $1,000 payment for ...

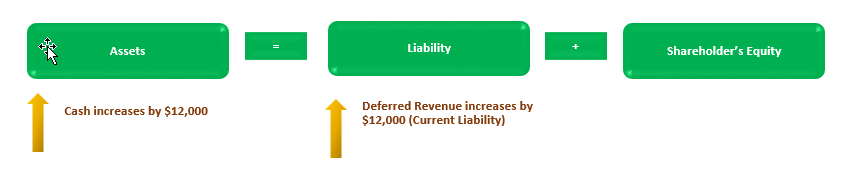

How to Account For Deferred Revenue: 6 Steps (with Pictures) 2021-03-04 · The company receives cash (an asset account on the balance sheet) and records deferred revenue (a liability account on the balance sheet). In the example from Part 1, the company receives a $120 advance payment relating to a twelve-month magazine subscription. When the company receives payment (but before delivering the subscription), the company …

Deferred Tax Asset Journal Entry | How to Recognize? Deferred tax asset (liability) (6,000) 3,000: 3,000: Microsoft Deferred Income Tax Statement. Microsoft Corp is a US multinational company Multinational Company A multinational company (MNC) is defined as a business entity that operates in its country of origin and also has a branch abroad. The headquarter usually remains in one country, controlling and coordinating all the …

Deferred Revenue (Definition)| Accounting for Deferred Income Thus, the Company reports it as a deferred revenue a liability than an asset until the time it delivers the products and services. It is also called as unearned revenue or deferred income. Examples A good example is that of a magazine subscription business where this revenue is a part of the business.

Deferred Revenue, Basic Accounting Transactions, Financial ... Deferred revenue is sometimes called unearned revenue, and it is through the use of this term that I believe it makes it easier to understand why it is initially a liability but is later transferred to an asset item. One of the most basic concepts of accounting involves determining if an item is an asset or a liability. Cash is an asset.

Is Deferred income an asset? - AskingLot.com Deferred revenue refers to payments received in advance for services which have not yet been performed or goods which have not yet been delivered. These revenues are classified on the company's balance sheet as a liability and not as an asset. Click to see full answer. Also asked, what is deferred income on balance sheet?

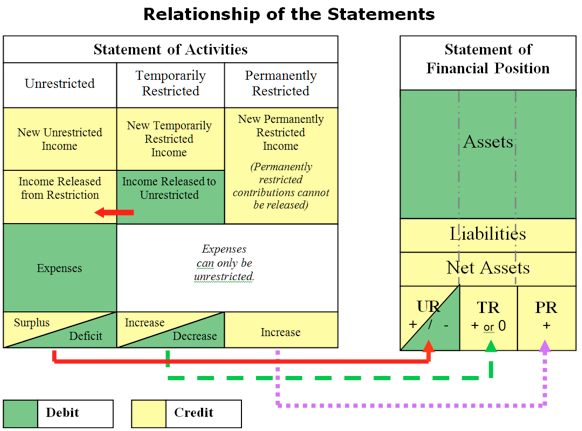

REVENUE RECOGNITION - BDO USA, LLP Revenue from Contracts with Customers. 1 It is generally converged with equivalent new IFRS guidance and sets out a single and comprehensive framework for revenue recognition. It takes effect in 2018 for public companies and in 2019 for all other companies, and addresses virtually all industries in U.S. GAAP, including those that previously followed industry-specific guidance …

What are Deferred Revenue and Unbilled Revenue? - SaaS CFO ... Each of these accounts has alternative names. Deferred Revenue is also called Unearned Revenue or Contract Liability. Unbilled Revenue is also called Accrued Revenue or Contract Asset. Deferred Revenue. Deferred Revenue results when invoicing exceeds the revenue you have recognized on a contract. That's why it doesn't exist in cash-basis ...

Revenue Recognition - Contract Assets & Contract ... Commonly referred to as deferred revenue or unearned revenue. A contract liability is an entity's obligation to transfer goods or services to a customer for which the entity has received consideration from the customer (or the payment is due, see Example 2) but the transfer has not yet been completed.

What is Deferred Revenue: Definition, examples, importance ... Yes, deferred revenue is a liability and not an asset. The payment the company gets represents something owed to the customer. Deferred revenue examples All companies selling products or providing services that require prepayments deal with deferred revenue. Here are some examples: Advance rent Mobile service contracts Ticket selling

IFRS 15 Revenue from Contracts with Customers - Summary ... Dt Receivables Cr Contract asset 25000 Cr ???? 3 300 (revenue or profit from changes in fair value) Can company apply IFRS 9 for contract assets and asses the contract assets at the fair value ? In such case company will show differences in Profit or Loss statement 28300-25000 = 3300 UAH. Or company must change recognized revenue like additional bonus? Can …

How to Account for Deferred Revenue in Purchase Accounting Initially, companies record the prepayment amount as cash on the asset side, while the deferred revenue is accounted for as a liability. The deferred revenue in this case is considered a liability because it has not yet been earned; the product or service is still owed to the customer.

Deferred Revenue: U.S. GAAP Liability Definition Deferred Revenue — Liability Treatment. Following the standards established by U.S. GAAP, deferred revenue is treated as a liability on the balance sheet since the revenue recognition requirements are incomplete. Typically, deferred revenue is listed as a "current" liability on the balance sheet due to prepayment terms ordinarily lasting ...

Presentation of Contract Assets and Contract Liabilities ... A contract liability may be called deferred revenue, unearned revenue, or refund liability. The change in terminology simply reflects ASC 606's revenue model, in which reclassification from a contract asset to a receivable is contingent on fulfilling performance obligations— not on invoicing a client.

Deferred Tax - Double Entry Bookkeeping 2020-01-13 · The tax authority gave an allowance of 2,400 on the asset, and the business charged a depreciation expense of 1,000, the difference of 1,400 at the tax rate of 25% is the deferred tax of 350. The double entry bookkeeping journal to post the deferred tax liability would be as follows:

Deferred Tax Liability (or Asset) - How It's Created in ... A deferred tax liability or asset is created when there are temporary differences between book tax and actual income tax. There are numerous types of transactions that can create temporary differences between pre-tax book income and taxable income, thus creating deferred tax assets or liabilities.

What Is The Difference Between Deferred Revenue And ... An excellent example of a business that deals with deferred revenue is one that sells subscriptions. Gradually, that revenue will shift from a liability to an asset as the company fulfills its obligations. 9In practice, the unearned revenue balance is commonly used to estimate a buyer's future cost.

Why is Deferred Revenue Treated as a Liability? Deferred revenue, which is also referred to as unearned revenue, is listed as a liability on the balance sheet because, under accrual accounting, the revenue recognition process has not been...

Is Deferred rent an asset? - FindAnyAnswer.com Deferred rent is defined as the liability that is created as a result of the difference between the actual cash paid and the straight-line expense recorded on the financial statements. Also Know, is Deferred rent a current or long term liability?

Is Deferred Revenue a Liability? - Baremetrics Aug 25, 2021 · Deferred revenue shows up in two places on the balance sheet. First, since you have received cash from your clients, it appears as part of the cash and cash equivalents, which is an asset. However, since you have not yet earned the revenue, deferred revenue is shown as a liability to indicate that you still owe the client your services.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-07-31at3.56.40PM-f53c6447715749d79f242c0a0759fbb5.png)

![Problem 12 [DTD-deferred revenue-inverted] ABC's tax | Chegg.com](https://media.cheggcdn.com/media/b8d/b8d8d50b-6f7b-4c1e-bf67-13ad15f95187/php8tls0U)

![Solved] Presented below are the 2021 income statement and ...](https://www.solutioninn.com/images/question_images/1568/8/9/3/9495d836bfd670371568877237224.jpg)

0 Response to "40 deferred revenue asset or liability"

Post a Comment